Electric Vehicle Adoption and Infrastructure: Findings of the 2025 Constituent Survey

1. Executive Summary

This report presents an analysis of findings from a recent constituent survey focused on attitudes, behaviours, and barriers related to electric vehicle (EV) adoption. The key conclusion is that while there is significant underlying interest in transitioning to electric mobility, this progress is severely undermined by uncertainty and well evidenced concerns. The primary barriers identified are the high total cost of ownership, the unreliable and complex public charging infrastructure, and major concerns regarding the long-term viability and depreciation of second-hand eclectic vehicles. The market is currently split between early adopters who rely on private home charging, and a large cohort of undecided drivers who perceive the transition as premature and unsupported by adequate government and industry readiness.

2. Current Vehicle Ownership and Future Market Intent

A total of 186 people took part in the survey. The majority of respondents owning one or multiple cars (75% and 20%, respectively). In terms of current vehicle composition, around two-thirds utilise traditional petrol or diesel internal combustion engines (ICE), while nearly one-third are fully electric, and the remaining 10% are hybrids. The relatively high rate of EV ownership in the sample suggests respondents are likely more informed or engaged with the topic compared to the general population.

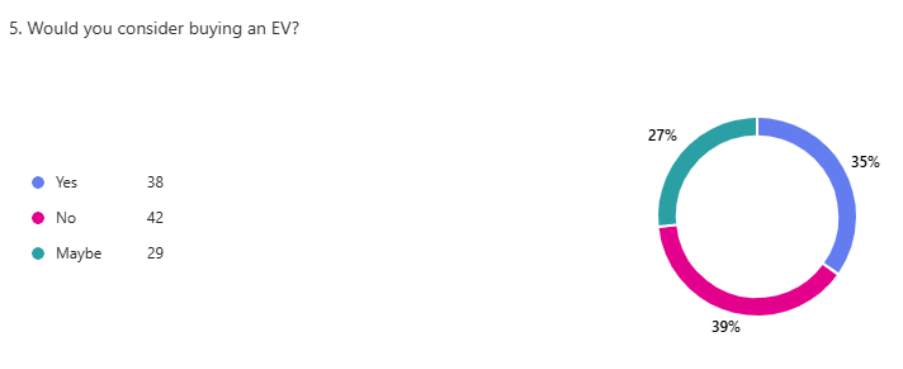

Anticipated market activity is high, with 60% of respondents expecting to purchase a new vehicle within the next few years. However, this intent does not translate into a clear consensus on electric adoption. When assessing future purchase intentions for an EV, responses were almost equally divided: 35% expressed a definitive ‘yes,’ 39% a definitive ‘no,’ and 27% remained undecided. This significant level of uncertainty points to persistent, influential barriers that are preventing conversion, notably concerns around cost, the state of the charging infrastructure, and long-term confidence in the technology.

3. The Critical Challenge of Charging Infrastructure

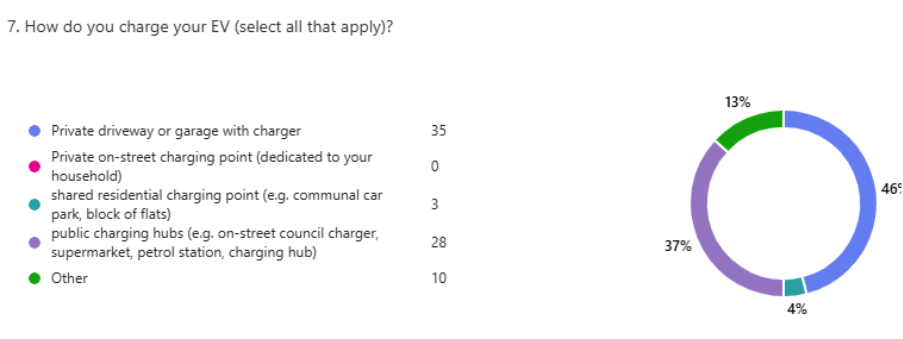

Analysis of charging behaviour among current EV owners highlights a critical structural challenge in the market. Just under 50% of respondents who currently own an EV, primarily rely on private charging facilities, such as a driveway or garage. This reliance demonstrates that the immediate accessibility of home charging is essentially a prerequisite for convenient EV ownership. Public charging hubs constitute the second most common method, while only 4% utilise shared residential charging points and none report access to private on-street chargers.

This finding underscores a substantial structural barrier for those living in high-density urban environments, particularly tenements or properties without dedicated off-street parking. While essential, public charging is widely reported as fundamentally unreliable and inadequate, directly creating a divided market that structurally disadvantages many inner city residents.

4. Public Charging Experience and Qualitative Failures

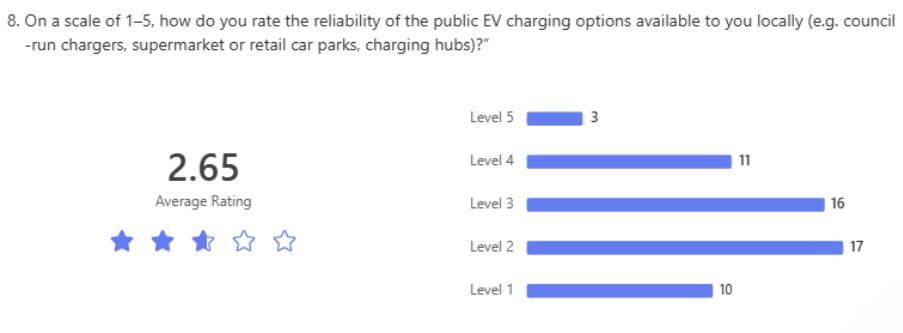

Satisfaction levels with public charging options are notably low, scoring an average of just 2.65 out of a possible 5.0. The qualitative data provides systemic evidence supporting this low satisfaction, identifying recurring and compounding problems that severely undermine the user experience:

- Availability and Speed: Respondents cited limited overall availability, insufficient provision of rapid charging options, and time limits on urban chargers that are deemed too restrictive for effective use.

- Reliability and Maintenance: Systemic reliability issues were highlighted, with the frequent breakdown of council chargers and unacceptably long repair times being major points of frustration. Furthermore, many spaces are reported to be blocked by non-EV (ICE) vehicles.

- Complexity and Cost: The user experience is significantly hampered by poorly maintained chargers, complex operations often requiring multiple incompatible apps, confusing pricing structures, and poor mobile network coverage needed to initiate charging sessions. The high cost of rapid charging was also frequently cited as prohibitive.

This catalogue of frustrations – inconsistent availability, complex user interfaces, poor maintenance, and cost – potentially acts as a significant deterrent, directly contributing to the slow adoption rate among the substantial cohort of undecided drivers.

5. Market Barriers and Consumer Confidence

The survey highlights that consumer hesitation is driven by a blend of practical and financial concerns:

5.1 Cost Perception and Financial Incentives

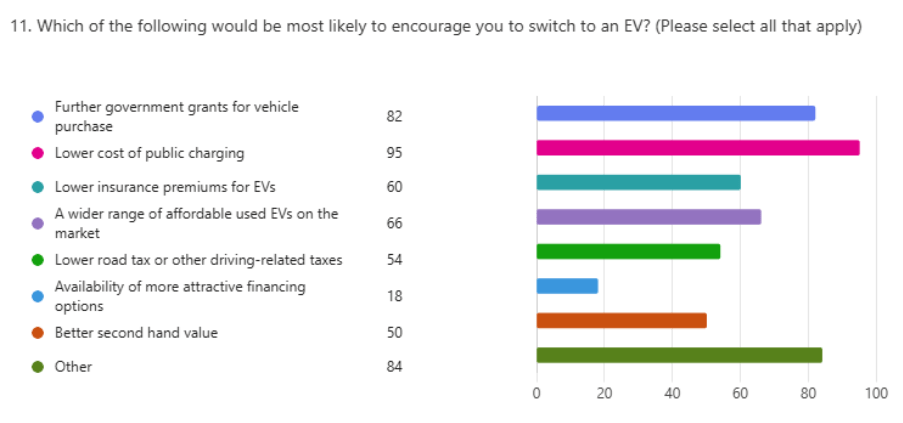

Two-thirds of respondents believe the overall cost of EV ownership is currently more expensive than equivalent petrol or diesel vehicles, with only 16% viewing EVs as cheaper. When asked for the most effective incentives to encourage switching, respondents prioritised lowering the cost of public charging and increasing the value or availability of government grants for vehicle purchase.

5.2 Second-Hand Market Uncertainty

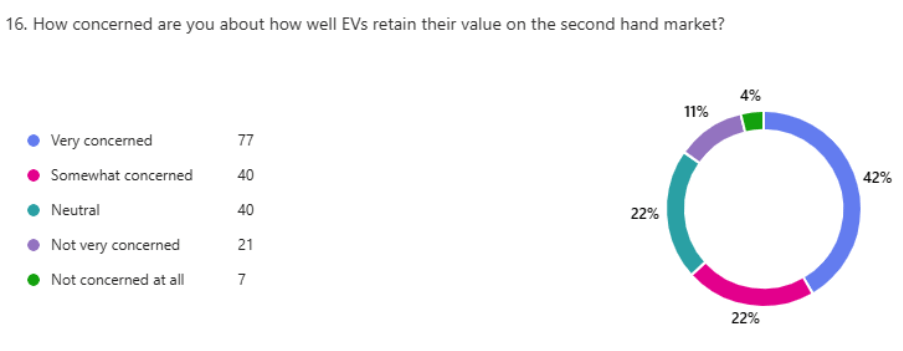

Confidence in the residual value of EVs is low. Three-quarters of respondents believe used EVs are both too expensive and insufficiently available. This is compounded by significant long-term concerns, with over 60% of respondents worrying about battery degradation and two-thirds expressing concern over future resale value. These factors present serious financial risks to mass adoption, requiring clear policy and industry guarantees to mitigate.

5.3 Range Anxiety vs. Practical Suitability

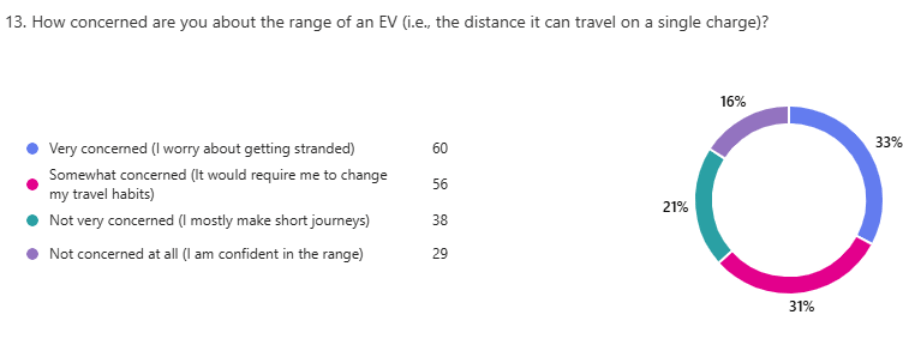

Range anxiety remains a prominent psychological barrier, with two-thirds of the sample expressing concern over battery range. Paradoxically, 71% simultaneously believe that an EV would meet their typical daily and weekly travel needs within and around the city. This disparity suggests that perceived range anxiety is not primarily driven by mileage requirements but is instead linked to concerns over charging infrastructure reliability i.e. the fear being not that the car cannot travel the distance, but that an available and functional charger will not be present at the destination.

5.4 Transition Readiness and Consumer Protection

Respondents are split on the pace of the national transition. While some advocate for stronger local incentives, such as reduced parking charges for EVs, many others feel the transition is moving too quickly without the foundational infrastructure being in place. This view is summarised by the concern that the government is asking owners to change without the necessary supporting systems: cars that are affordable and infrastructure that is robust. Furthermore, consumer protection issues were raised regarding chargers advertised as public but located within private car parks, leading to unexpected parking charge notices.

6. Conclusions

The findings indicate that the primary focus of policy intervention must shift from simply encouraging purchase to ensuring a fair, reliable, and accessible user experience across the entire lifecycle of EV ownership.

- Cost and Financial Risk: Cost remains the foremost barrier, encompassing both high upfront purchase prices and the ongoing expense of public charging.

- Public Infrastructure Failure: The current public charging network is failing consumers on multiple fronts: reliability, availability, user experience complexity, and cost.

- Market Division: Residents without off-street parking face a structural disadvantage. Innovative, competitively priced, and conveniently located kerb-side or shared charging solutions are needed to help achieve equitable adoption in urban centres.

- Information and Confidence: The prevalence of informal information sources suggests a clear opportunity for local authorities and trusted community organisations to provide clear, accessible, and evidence-based guidance to counter range anxiety and allay concerns regarding battery longevity and maintenance.