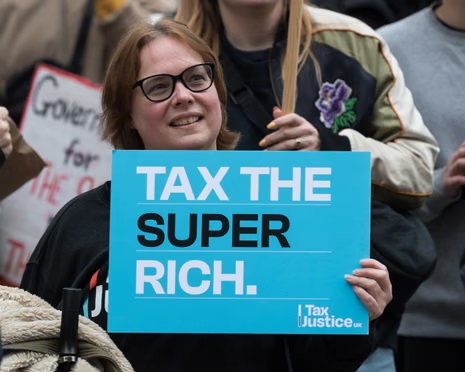

The UK wealth tax debate has intensified ahead of the Autumn 2025 Budget. Advocates argue a tax on assets over £10 million could raise £12–24 billion annually and help tackle inequality. Critics warn it risks harming investment, growth, and business competitiveness.

Implementation challenges include asset valuation, liquidity issues, and potential capital flight. Within that context, he text below is an objective assessment of the situation I requested from the (independent) House of Commons Library.

Wealth Tax – An Assessment.

The following countries in the Organisation for Economic Cooperation and Development (OECD) have, at some point, introduced a wealth tax:

- Norway

- Spain

- Switzerland

- Austria

- Germany

- Finland

- France

- Ireland

- Luxembourg

- Netherlands

- Sweden

Of these countries, a wealth tax is only currently active in Norway, Spain, and Switzerland (Perret, S, Why did other wealth taxes fail and is this time different? (PDF) (2020), Wealth Tax Commission Evidence Paper 6)

Benefits

A majority of the existing literature focuses on the challenges encountered by countries that had introduced wealth taxes, particularly since a majority of these countries has now abolished them.

The Wealth Tax Commission, which researched the potential case for a wealth tax in the UK in 2020 (PDF), found that the most popular reasons people believed a wealth tax should be introduced for was to raise additional revenue (for example, to support the public finances after the Covid-19 pandemic) and for reasons of fairness (therefore hinting at redistributive goals).

Evidence from a majority of wealth taxes, analysed by the OECD in 2017 (PDF), shows that a majority of them raised very little revenue, and there were concerns that the taxes failed to meet redistributive goals. Indeed, the authors argue that “the limited revenues collected from wealth taxes have made their elimination more acceptable and feasible from a political point of view.” (p17)

Challenges

In their 2017 analysis, the OECD lists the arguments that have been proposed to justify the repeal of wealth taxes:

The main arguments relate to their efficiency costs and the risks of capital flight, in particular in light of increased capital mobility and wealthy taxpayers’ access to tax havens; the observation that net wealth taxes often failed to meet their redistributive goals as a result of their narrow tax bases as well as tax avoidance and evasion; and concerns about their high administrative and compliance costs, in particular compared to their limited revenues. (OECD, The Role and Design of New Wealth Taxes in the OECD (PDF), 2017, p17)

An analysis of wealth taxes that have been implemented in OECD countries (PDF – including those that have since been repealed) was conducted by the OECD’s Sarah Perret in 2020, for a submission to the UK’s Wealth Tax Commission. The article focusses on the key theoretical factors that could have led to the decline of wealth taxes across the OECD since the 1990s, and concludes that the primary challenges related to “widespread avoidance and evasion“, which have been corroborated by many pieces of research (p22). Perret suggests that, over time, the scope of wealth taxes had narrowed by an increase in exemptions and reliefs, which have been used by taxpayers to limit their tax exposure. She suggests political activities had contributed to this:

Importantly, however, the design of wealth taxes was partly the result of political economy dynamics, with evidence that interest groups were influential in obtaining special exemptions, for instance. (p22)

Earlier, the paper had noted how generally wealth taxes accounted for a small share of tax revenues, ranging from 0.5% of tax revenue in Spain to 3.9% in Switzerland. Switzerland’s case is an international outlier, and its wealth tax’s share of total taxation is consistently higher than other countries. See page 6 of the report for further information.

Additionally, Perret pointed to the cost to the state of administering the tax as a challenge; she added that this could be addressed at least partly by better tax design:

The administrative and compliance costs that wealth taxes have involved have indeed been significant, in particular in relation to regular asset valuation, and higher than in the case of taxes on wealth transfers, which are only levied once, or income taxes. (p22)

Length of implementation in other countries, and potential implementation in the UK

I have not found information of the length of the implementation period of wealth taxes in other countries using routinely published sources. The available evidence suggests a variety of situations. For example, in Spain, the first iteration of its wealth tax was implemented via an emergency decree in 1977, suggesting a speedy implementation (see Ramallo, A, Wealth tax: Spain (PDF), 2020, Wealth Tax Commission International Background Paper; and Spence Clarke, A Guide to Wealth Tax in Spain (PDF), accessed August 2025). Additionally, in the most recent implementation in 2011 there may have been elements of the previous tax that were maintained (particularly in relation to administration). In Germany, where a wealth tax existed until it was ruled unconstitutional in 1995, the development of the tax appears to have been more iterative, with “simple forms of wealth taxes hav[ing] been imposed in Germany since the Early Middle Ages.” (Rehr, R, Financing COVID-19 costs in Germany: is a wealth tax a sensible approach? (PDF) (2020), Wealth Tax Commission International Background Paper). It therefore may be difficult to draw effective comparisons.

In their final report in 2020 (PDF), the Wealth Tax Commission discussed the potential timeline of implementation of a wealth tax in the UK. In the case of a one-off wealth tax, rather than a recurring one (the proposal endorsed by the commission), they suggested an announcement and implementation with immediate effect, with a majority of the preparation work having been done in advance, and in secret (pp75-76).

In the case of an annual wealth tax, the commission relied on a study by Pope and Tetlow (2020, PDF) which argued that the creation of the tax (from inception to operation) could take a total of four years. The commission argued that their research and preparatory work could shorten this timescale by 24 months.